2022 performance & progress on Impact24

.

In this first year of Impact24, and my last full year as CFO of Ageas, I am pleased that we were able to deliver solid results across the Group against the backdrop of unfavourable financial markets in Asia, rising inflation and adverse weather conditions in Europe throughout the year. The strong operational performance and solid capital position allows us to deliver on our progressive dividend commitment. Still in 2022, we further reduced our reliance on a grandfathered debt instrument, successfully closing a liability management action on a legacy securities instrument

Christophe Boizard, CFO

I'm honoured to be taking up the role of CFO of Ageas and thrilled to continue the excellent work of my predecessor. Ageas has a strong reputation for delivering and I look forward to working with the Groups entire finance community and the business to contribute to the achievement of our objectives and to Ageas's sustainable growth.

Wim Guilliams, Deputy CFO

Non-financial & Sustainability Performance

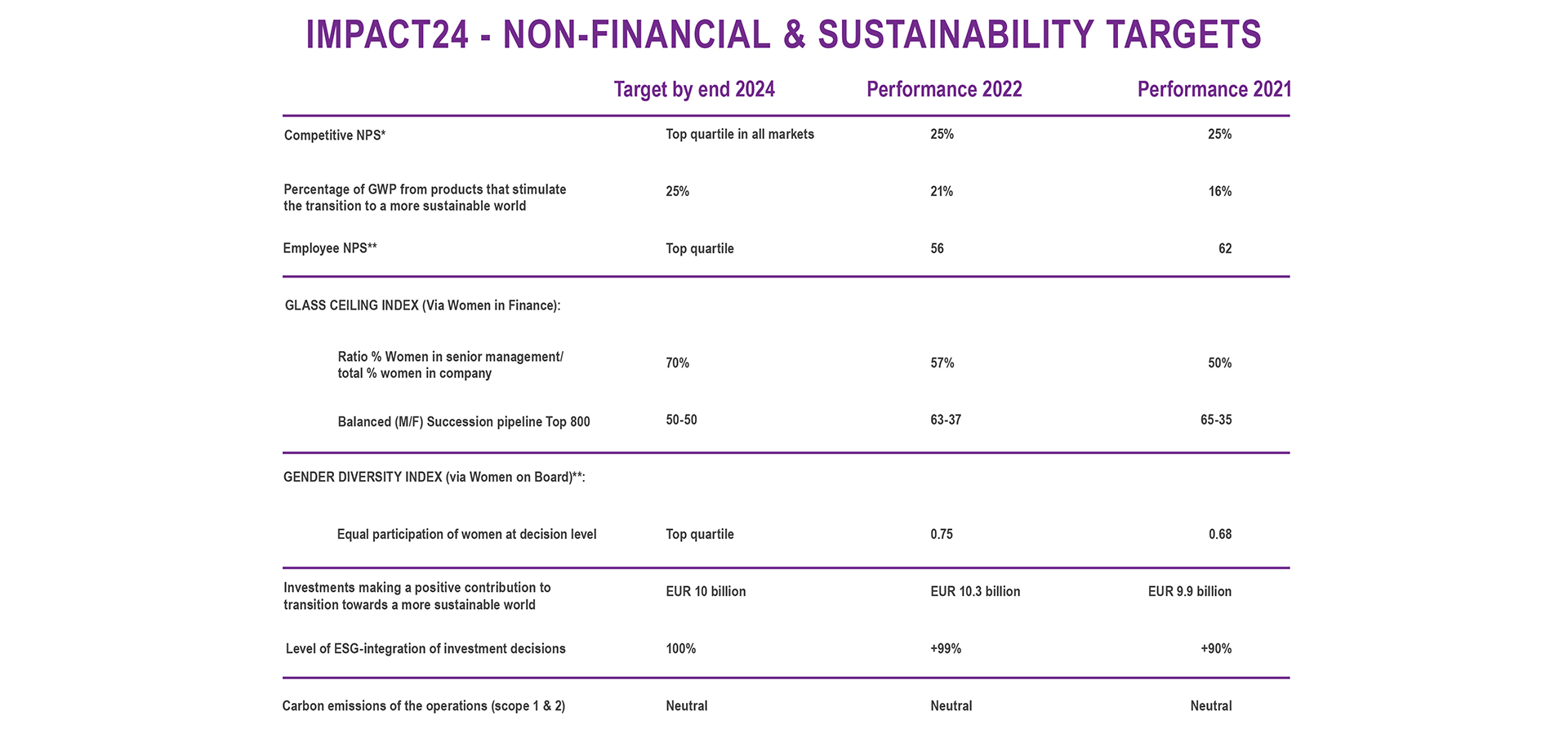

With Impact24, sustainability sits at the heart of everything Ageas does. Next to the financial and operational targets on which Ageas has already been reporting, specific non-financial and sustainability targets have now assumed a prominent place to demonstrate progress on the commitments taken towards the Groups stakeholders. Throughout the year, we took important steps in delivering on our Impact24 strategic ambitions in terms of growth, commercial excellence, integration of data & technology, our people and sustainability. As a result, our non-financial and sustainability targets, reported for the first time, showed good progress on many fronts.

If anything, the past year increased our conviction that Impact24 is the right plan at the right time.

Gilke Eeckhoudt , CDSO

Solid Group performance

Group net profit for the full year 2022, excluding the impact of the financial markets in Asia, exceeded the EUR 1 billion mark reflecting the solid result in Belgium and the strong underlying result in Asia. The Life margins for the consolidated entities all met the Group s Impact24 targets, while the Non-Life Combined ratio slightly fell short mainly due to above average bad weather. The Operational Free Capital Generation, including both the Solvency II and the non-Solvency II scope, amounted to a strong EUR 1,172 million. This supports the Group s commitment of a dividend per share growth trajectory of 6-10% over the current strategic cycle Impact24.

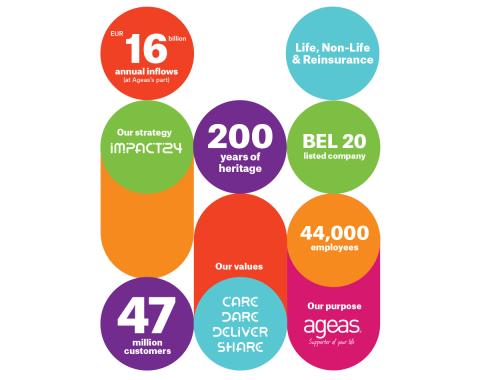

Group inflows including the non-consolidated entities (at Ageas s part) were 2% up compared to last year and amounted to EUR 16 billion. Growth in Life inflows was driven by new business sales in China, supported by a strong fourth quarter. In Portugal and Belgium, the volumes in individual Life products decreased due to uncertain financial markets. Non-Life inflows increased in the mature markets of Belgium and Portugal as well as in the Asian partnerships, driven by portfolio growth and tariff increases in response to increased inflation.

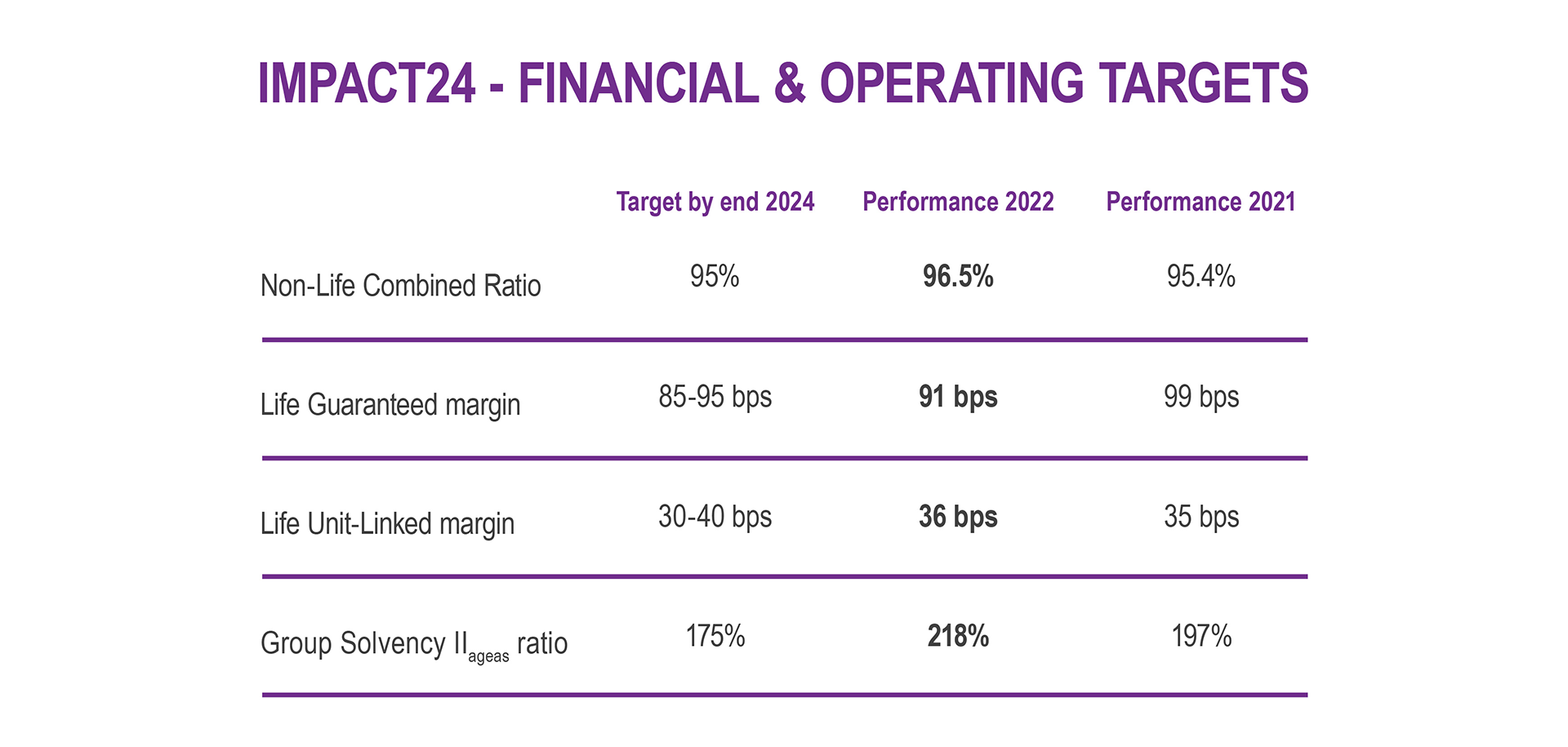

The Non-Life combined ratio for the consolidated entities stood at 96.5%, including a higher-than-average impact of adverse weather across the year (4.3 pp), affecting the profitability of the European and reinsurance segment in particular. The impact on the Group net result amounted to EUR 144 million.

At 91 bps, the Guaranteed operating margin of the consolidated entities was comfortably within the target range. The impact of the volatile equity markets at the beginning of the year was fully compensated for by gains realised on transactions on the Real Estate book.

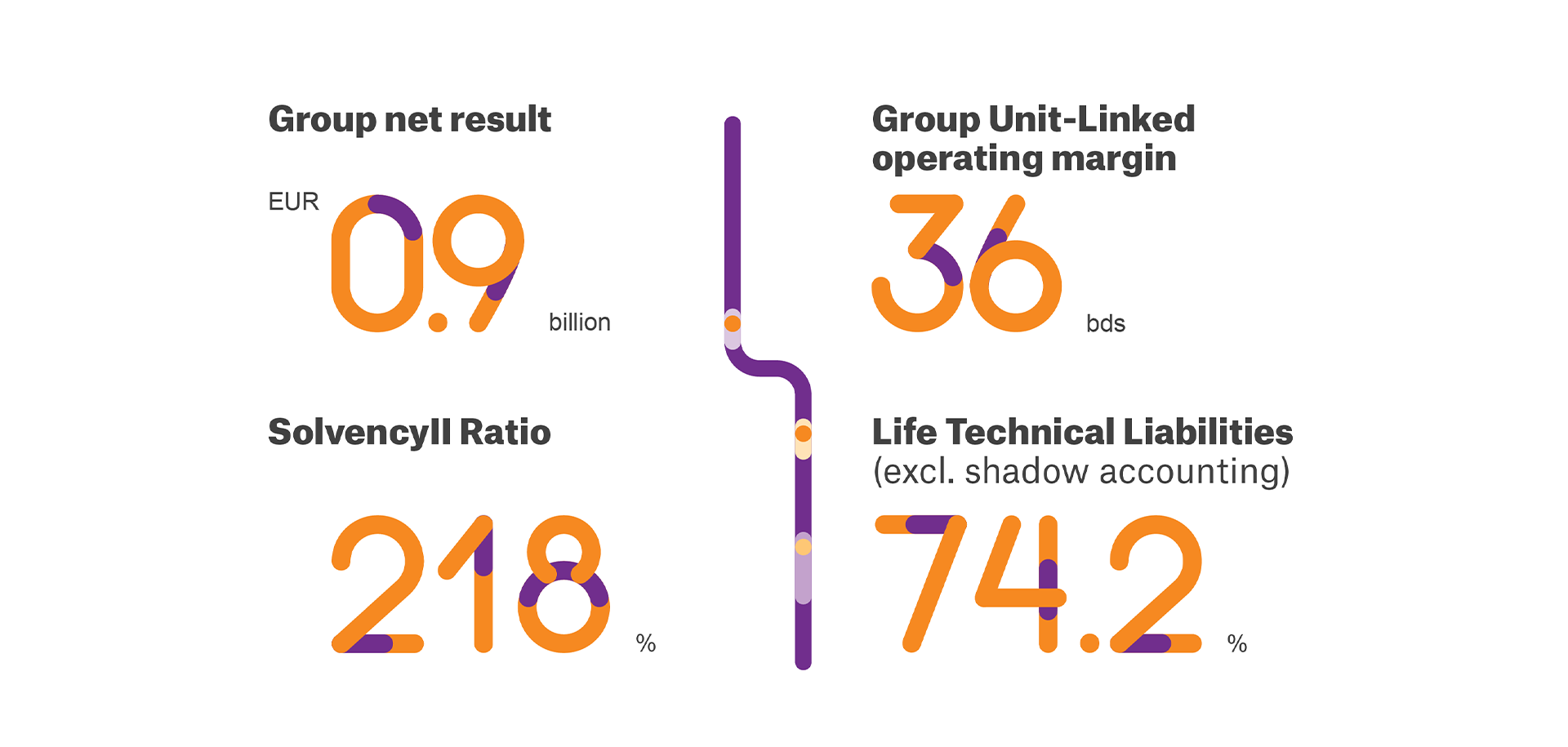

The Group Unit-Linked operating margin continued its steady improvement and stood at 36 bps driven by improved expense margins in Belgium and Portugal.

The 2022 Group net result, excluding RPN(i), amounted to EUR 871 million. When excluding the non-recurring capital gains and the impact from the financial markets in Asia, the net result excluding RPN(i) would have reached EUR 1,062 million.

Life Technical Liabilities for Ageas s part excluding shadow accounting for the consolidated entities, decreased 1% compared to the end of 2021, due to market volatility, mainly in Unit-Linked products. The increase in the Life Technical Liabilities in the non-consolidated entities was driven by continued growth in new business and high persistency levels.

Ageas's Solvency IIageas ratio increased by 21 percentage points over the year, to a high 218 %, largely above the Groups target of 175%. This increase was driven by the strong operating performance of the Group and by the rise in interest rates. The contribution of the insurance operations fully covered the accrual of the expected dividend