Are you ready for the most impactful trends on the horizon?

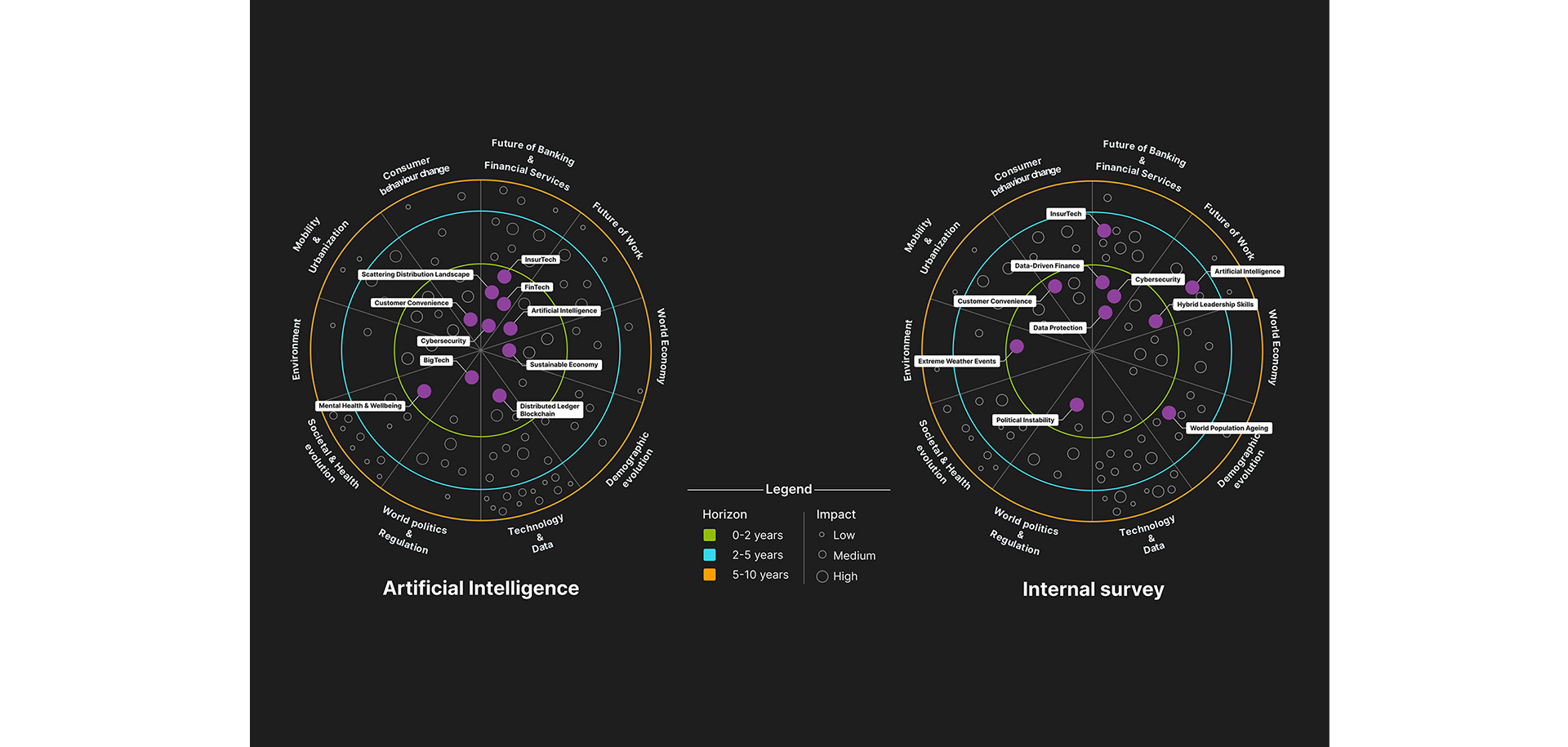

If you are curious about what the future might hold, then read on! Out of the 139 trends Ageas scanned in 2022, these are a few of the standouts identified by our AI engine and human survey that will likely drive transformational change across our industry.

Systemic shock related trends featured heavily in 2022 and it’s no surprise.

Globalisation and IT development over the past decade have reshaped societies: we are more interconnected and interdependent than ever. Systemic shocks have increased in frequency and intensity, but we also see the domino effects that amplify the impact even further. What are we referring to? Cybersecurity, extreme weather events, social instability, and yes… pandemics, all make it on the list.

Non-traditional “disruptors” are changing the distribution landscape and gaining traction.

Competition is fiercer than ever, with the rise of disruptive business models beyond traditional approaches, whilst searching for a viable financial proposition. New technologies allow for the entry of novel players with no legacy burden, appealing customer propositions and differentiating products. Think FinTech, Insuretech and Big Tech. As well, next-gen partnerships are driving innovation in the industry, creating opportunities to improve convenience for the customers.

A new working paradigm emerged under the impulse of Covid.

Hybrid leadership, remote working, work-life balance and reskilling all rank high in the results of our internal Horizon Scan survey. It is a fact that the employer/employee dynamic is shifting. Rising living standards in developed countries have also reduced the time that people spend working. New employer attributes such as flexible working, wellbeing and contribution to solving environmental/societal issues are all gaining traction in the war for talent.

Blockchain related trends were rated highly impactful by AI results, but less so in the survey by our people.

Blockchain technology - distributed ledgers, cryptocurrencies and Non-Fungible Tokens (NFT’s) - have certainly gone through a few hype-boom-bust cycles over recent years. While this technology carries the potential for radical change, we observe still low (but growing) adoption within the insurance industry. Recent crypto crashes have impacted consumer confidence in blockchain, which might significantly slow down progress & adoption.